Businesses can gain the confidence they need to fuel better decisions

faster

SAN JOSE, Calif.--(BUSINESS WIRE)--

BILL (NYSE: BILL), a leading financial operations platform for small and

midsize businesses (SMBs), today announced innovative cash flow forecasting

and insights capabilities designed to empower SMBs and their accountants to

predict future cash flow, understand trends and opportunities, and make

better business decisions, faster.

The new offerings, BILL Insights and BILL Cash Flow Forecasting, are

integrated into the

BILL Financial Operations Platform, which already provides category-leading accounts payable (AP), accounts

receivable (AR), and spend and expense solutions. With these new

enhancements, BILL delivers the most comprehensive financial operations

platform enabling SMBs to optimize, manage, and forecast cash flow within a

single platform. BILL Insights and BILL Cash Flow Forecasting are currently

available to select SMB and accountant customers of BILL and will become

more widely available in calendar Q1 2024.

“For SMBs, data drives success. Decisions on how, when, and where to

allocate capital, make new investments, or adapt business strategy require

timely forecasting and insights capabilities that are actionable,” said

Irana Wasti, Chief Product Officer at BILL. “This is the first integration

of innovative technology from our acquisition of

Finmark

into our platform since it was completed. We are now delivering even more

powerful and comprehensive tools that will help SMBs better manage their

cash flow and optimize their business for success.”

SMBs Need Clarity, Control, and Confidence

SMBs are resilient, but they are operating in a complex and changing

economic and business environment. There are

33 million SMBs

in the US, comprising 99.9% of all US firms. The strategic financial and

business decisions made by every one of these SMBs today, will determine

their ability to grow and succeed into the future. The challenge for SMBs is

that without timely and actionable data and insights, they are left guessing

at their future.

Only 38% of SMBs are using dedicated financial and analysis planning tools

according to

research from BILL. In addition, according to

The BILL 2024 State of Financial Automation Report, 84% agree that automated financial operations can help to provide the

insights needed to improve decision-making. Many businesses lack visibility

into cash flow trends or financial opportunities which could help them make

better business decisions. BILL is changing that, by removing the guesswork

of cash flow forecasting and decision-making.

Predict Future Cash Flow and Get Timely Visibility Into Business

Performance

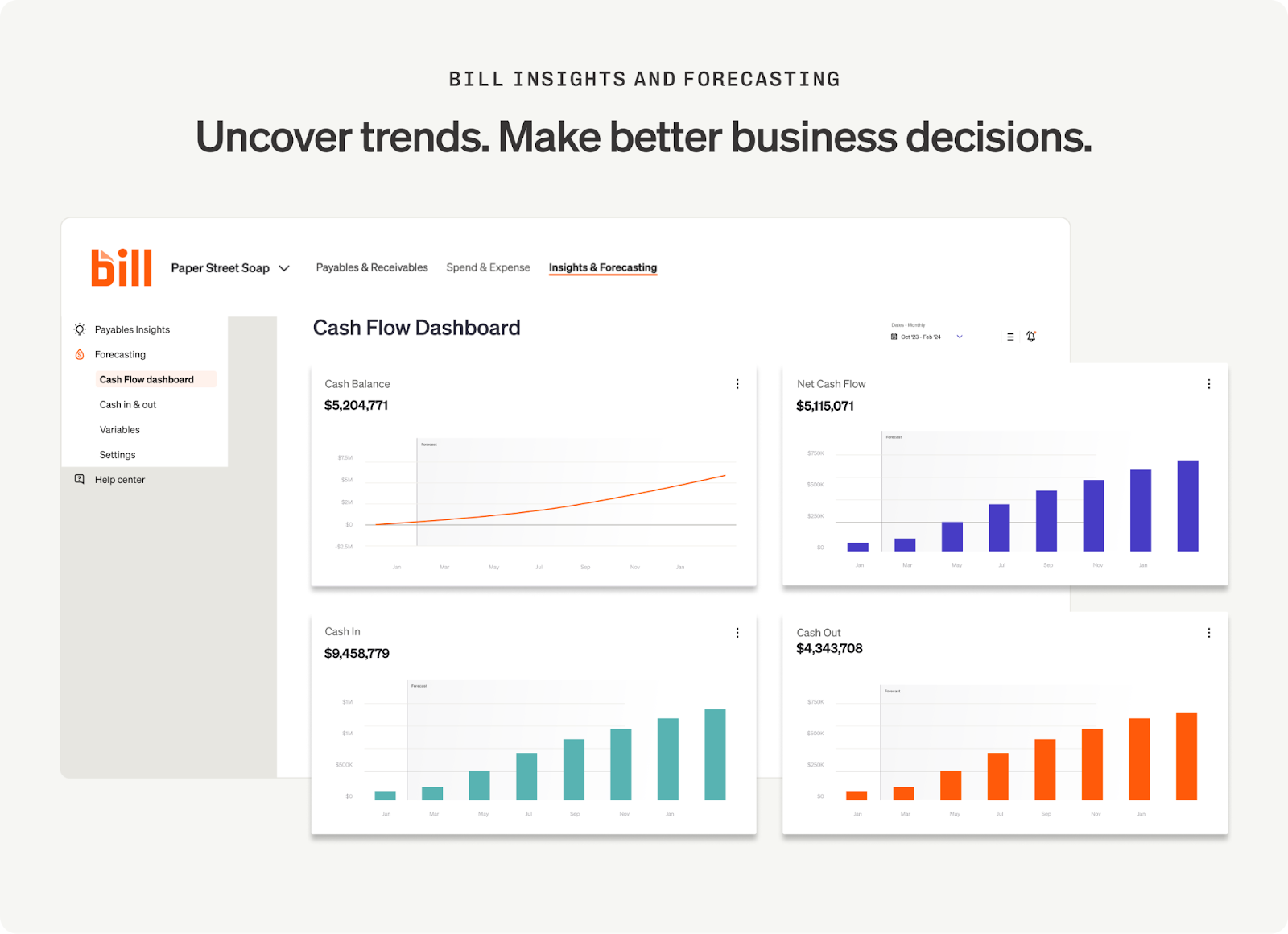

BILL Cash Flow Forecasting provides SMBs with the clarity and control needed

to manage business today and confidently plan for tomorrow. BILL leverages

accounting data to quickly generate forecasts to fuel better business

decisions.

Key Benefits Include:

-

Predict future cash flow: Leverage historical accounting data to

quickly generate cash flow forecasts. Look ahead up to thirteen months

with predictive cash flow modeling.

-

Get timely cash flow visibility: Access cash flow dashboards with

metrics including cash in and cash out, net cash flow, and cash balance.

-

Stay on track with visual cash flow metrics: Track business

performance by comparing budgets against actual cash flow. Easily run

“what if” simulations to forecast how business decisions could impact

future cash flow.

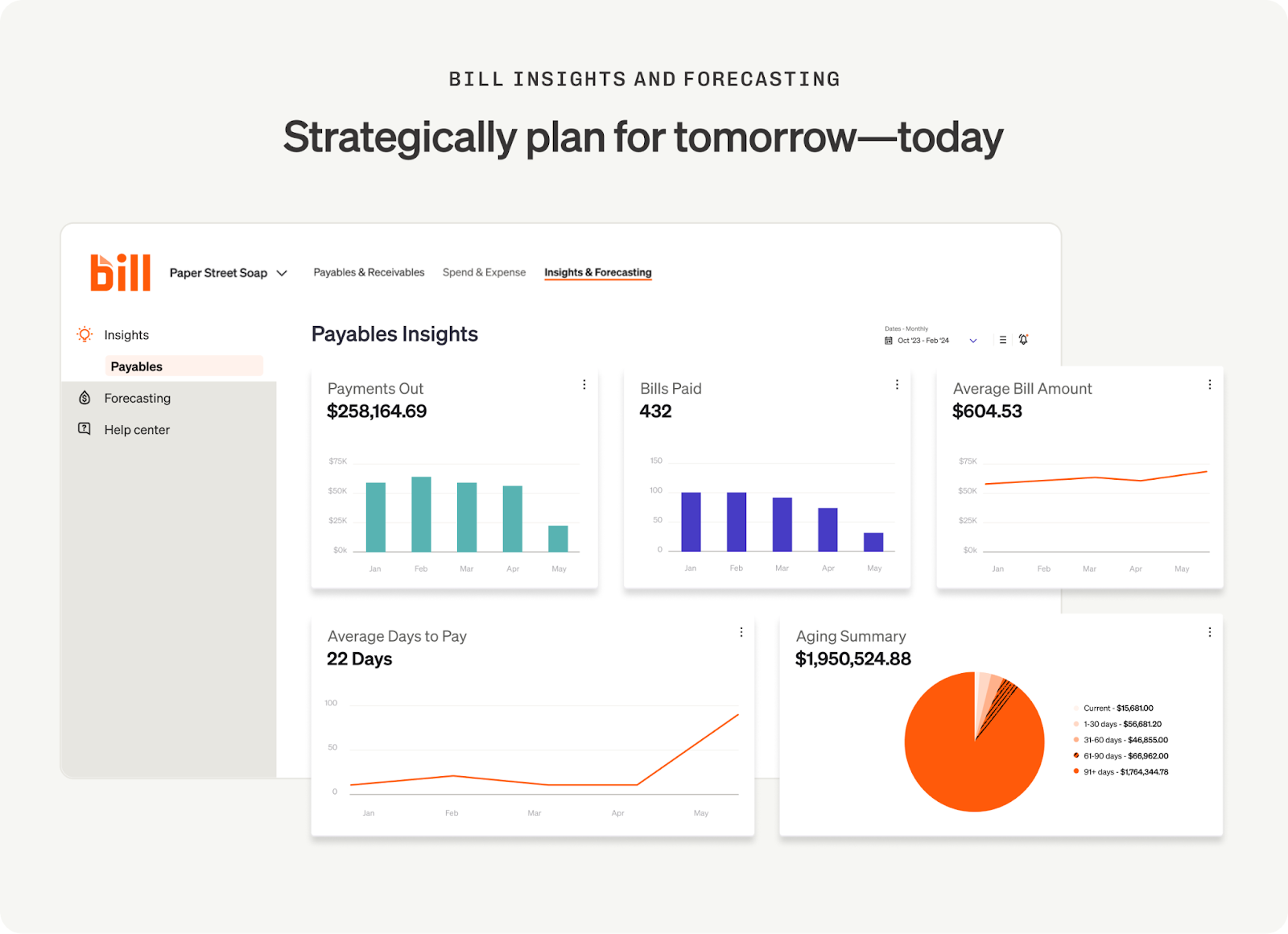

Identify Financial Trends to Maximize Business Potential

BILL Insights delivers visibility into AP trends with out-of-the-box

dashboards. The visual guide provides a view of financial metrics to help

businesses spot actionable trends and proactively identify opportunities to

take action to optimize decisions, faster.

Key Benefits Include:

-

Scan key metrics quickly: Use easy-to-understand dashboards to view

financial metrics such as top vendors by amount paid, average days to pay,

aging summary, and more.

-

Take action to optimize business: Uncover trends and opportunities

to redirect business resources. Renegotiate payment terms, spot unusual

spikes in bill amounts, and identify ways to speed up AP payment

processes.

SMBs and Accountants Are Excited About BILL Insights & Forecasting

"The ability to curate automated dashboards and cash flow forecasts quickly

for stakeholders throughout our organization is incredibly valuable," said

Jennifer Dent, Senior Finance Manager at 1021 Creative. "Given our

international scope, it's imperative that our regional managers have clear

visibility and an understanding of their respective cash flow. The enhanced

BILL platform empowers me to equip our teams with the insights needed to

propel our business forward with confidence."

"Having visibility into actionable insights and cash flow forecasts for our

clients is an important part of our commitment to providing top-tier

financial guidance,” said Don Needs, CFO of accounting firm Jitasa.

"Automated dashboards and predictive cash flow modeling complement our

services and simplify our tech stack, making our work more efficient and

impactful. I look forward to helping our clients get more clarity over their

finances with these new tools enabling them to maximize their business

potential.”

Availability Overview

-

BILL Insights and BILL Cash Flow Forecasting are currently available to

select SMB and accountant customers of BILL and will become more widely

available in calendar Q1 2024.

-

Initial release of BILL Cash Flow Forecasting syncs accounting data from

QuickBooks Online. Future integrations with other accounting software

platforms are coming later this calendar year.

Learn More

-

Read more

from Irana Wasti, Chief Product Officer at BILL, about how your business

can benefit from cash flow forecasting and insights tools to help you make

more confident business decisions, faster.

-

Read

about the advantages of automated financial planning and analysis for

accounting firms.

About BILL

BILL (NYSE: BILL) is a leading financial operations platform for small and

midsize businesses (SMBs). As a champion of SMBs, we are automating the

future of finance so businesses can thrive. Our integrated platform helps

businesses to more efficiently control their payables, receivables and spend

and expense management. Hundreds of thousands of businesses rely on BILL’s

proprietary member network of millions to pay or get paid faster.

Headquartered in San Jose, California, BILL is a trusted partner of leading

U.S. financial institutions, accounting firms, and accounting software

providers. For more information, visit

bill.com.

Source: BILL